14/09/20Chancellor brings in Stamp Duty holiday, how much could you save?

As lockdown measures were brought in, property viewings ground to a halt and the number of sales fell sharply. If you were hoping to purchase a property, the good news is that the sector is now open for business again and you could benefit from a Stamp Duty holiday.

Following weeks of delays, home buyers surged in July. It was the busiest month for home buying in ten years, with more than £37 billion worth of property sales agreed, according to Rightmove. It coincides with Chancellor Rishi Sunak unveiling a temporary reduction in Stamp Duty rates. Whether you want to move up the ladder, purchase a holiday home or invest in Buy to Let, it could save you money.

Raising the Stamp Duty threshold

Unless you’re a first-time buyer, you’d usually need to pay Stamp Duty when buying a property in England or Northern Ireland. Scotland and Wales also have similar property taxes in place.

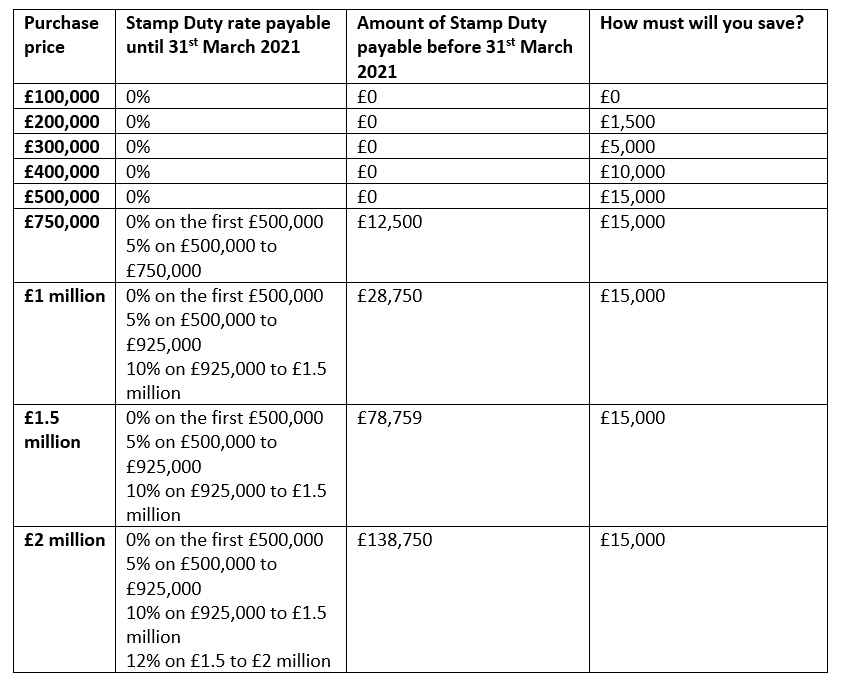

Previously, the Stamp Duty threshold was just £125,000. With the average property in the UK now worth £231,855, according to the House Price Index, the vast majority of buyers would need to pay some Stamp Duty. However, if you purchase before 31st March 2021, the threshold has increased to £500,000. As a result, 90% of buyers will not pay Stamp Duty during the temporary reduction.

It could save you thousands on the cost of moving. The table below highlights the potential savings.

What does the Stamp Duty holiday mean for you?

The impact of the Stamp Duty holiday, if you’re looking to buy a property, will depend on your position.

- First-time buyers: For most first-time buyers, the Stamp Duty reduction won’t result in lower costs. But it has stimulated the housing market, you may find more properties to meet your criteria available now.

- Home movers: Most home movers won’t need to pay Stamp Duty if they purchase before the end of March 2021. As a result, you’re likely to save thousands of pounds on the cost of moving.

- Purchasing a second home or Buy to Let property: You still benefit from the Stamp Duty holiday even if the new property won’t be your main home. You’ll need to pay the additional 3% Stamp Duty surcharge applied to second homes, but the overall cost will still be lower. It can make now the perfect time to invest if it’s something you’ve been considering.

When to file your Stamp Duty return

Even if the Stamp Duty holiday means you don’t need to pay the tax, you still need to file a return. You have 14 days to do this from when the purchase is complete, you must pay any Stamp Duty due at this point too. Usually, your solicitor will deal with this on your behalf. However, you can also file it yourself. If a return is filed late, interest will be added.

The Stamp Duty holiday can mean it’s the perfect time to move if it’s something you’ve been considering. If you’d like to discuss mortgage options or how investing in property fits into your wider financial plan, please get in touch.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate Tax Advice or Buy to Let Mortgages. Your home maybe repossessed if you do not keep up repayment on your mortgage. The value of tax benefits described depend on your individual circumstances. Tax rules can change.